Nuclear energy worldwide 2025

Different approaches are being taken around the world with regard to the utilisation of nuclear energy for power generation. There are three groups that can be roughly distinguished: While some are aiming to phase out nuclear energy in the short or medium term, others are extending the lifetimes of nuclear power plants (NPPs), while yet again others are planning new builds and in some cases are also focusing on lifetime extensions.

Here, the arguments put forward include the following: For example, supporters refer to the reliability with which electricity is supplied from nuclear energy or point to the comparatively low carbon footprint during operation, which is seen as a plus in the fight against climate change. Opponents, on the other, point to the risk of accidents, the expense associated with the disposal of radioactive waste, or the comparatively high costs and long construction times for building the plants.

This dossier provides an overview of nuclear energy worldwide. It is updated once a year and published on the GRS website.

Situation worldwide

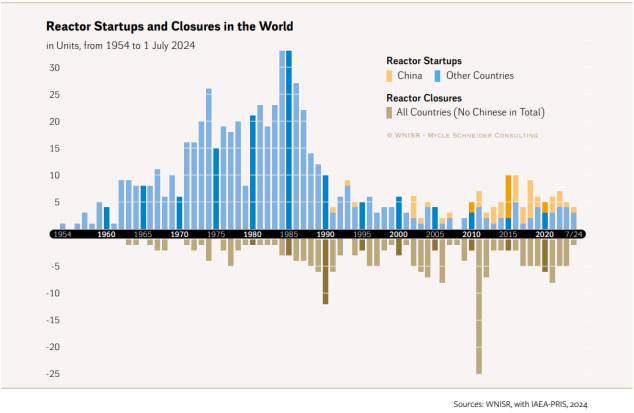

According to the Power Reactor Information System (PRIS) of the International Atomic Energy Agency (IAEA), there are currently 417 nuclear reactors in operation worldwide with an average age of around 32 years. In 2024, a total of six new reactor units were connected to the grid, and two Japanese units that had been shut down since 2011 (reactor disaster at the Fukushima NPP) were also restarted. On the other hand, four units have been decommissioned.

In addition to the reactors in operation, PRIS also lists 23 other reactors that are in service in ‘suspended operation’ mode. These are reactors that have been shut down for the long term but have not yet been permanently decommissioned. 19 of these plants, also known as ‘long-term outage reactors’, are located in Japan, the remaining four in India.

With regard to the PRIS figures, it should generally be noted that the respective IAEA countries enter their data into the database themselves. Delays that arise as a result can be a reason for deviations from other sources such as the ‘World Nuclear Industry Status Report’ (WNISR). The figures on the average age of the plants for our overview charts are taken from the WNISR. The average age refers to the first day of commercial operation.

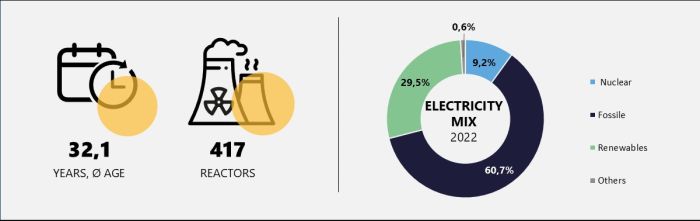

Net installed nuclear capacity increased by 5,536 to 377,046 megawatts of electricity (MWe) compared to the previous year. While the absolute amount of electricity generated in nuclear power plants worldwide has remained largely unchanged in recent decades, their relative share of the global electricity mix fell below the 10 per cent mark in 2022 for the first time in around 40 years (the peak value was 17.5 per cent in 1996).

On the one hand, this is due to the fact that more and more electricity is being generated using renewables; on the other hand, electricity generation based on fossil fuels has also increased significantly compared to previous years and decades.

The figures in this text relating to the global electricity mix and for the respective continents are taken from the International Energy Agency (IEA) and reflect the status in 2022; the figures relating to electricity generation in the individual countries are taken from the current WNISR and reflect the status in 2023.

The following trends can be recognised when looking at the constantly changing global reactor landscape: Most new reactor units are being built in Asia, whereas most of the reactors being dismantled are located in Western Europe and North America.

Accordingly, the average age of reactors in Asia is comparatively low. New reactor units also have a higher average output than those that have been decommissioned, meaning that the installed capacity can increase despite a decline in the number of reactor units. One exception is the so-called Small Modular Reactors (SMR): These miniature NPPs are expected to play an important role in the medium-term planning of low-carbon, decentralised electricity production in a number of countries.

[Note: Since 2022, the Russian Federation, together with the Central Asian republics, Azerbaijan and Georgia, has been included in the IEA's new Eurasia category. The figures for the European electricity mix therefore do not include the figures for the countries mentioned, which are included for Asia instead. As far as the number of reactors is concerned, we follow the IAEA system, which counts Russia as part of Europe].

Europe

In Europe, nuclear energy accounted for around 18.7 per cent of total electricity generation in 2022. A total of 168 reactors are in operation in Europe, with an average age of 34.8 years. 13 reactors are currently under construction and 129 are being dismantled.

Germany

Germany finally discontinued using nuclear energy to generate electricity in 2023: On 15 April, the last three nuclear power plants, namely Emsland, Isar 2 and Neckarwestheim II were finally shut down.

But NPPs are not the only nuclear facilities in Germany. The six research reactors currently in operation are still active. The same applies to the so-called nuclear fuel supply and waste management facilities. In addition to the storage and (future) disposal facilities for radioactive waste, these include the fuel assembly production plant at Lingen and the uranium enrichment plant at Gronau.

Western Europe

France has the world's largest percentage of nuclear energy in the national electricity mix. In 2022, it was 64.8 per cent. France also has the most reactors in Europe. The average age of French plants is 38.9 years. Flamanville-3, the first reactor since 1999, was connected to the grid at the end of 2024. The construction project began in 2007 and was originally scheduled for completion by 2012. However, the schedule was extended several times and the costs have multiplied since then - most recently from 12.7 to 13.2 billion euros (originally forecast at 3.3 billion euros); the French Court of Auditors even estimates the total costs, including financing, at 19.1 billion euros. Nevertheless, nuclear energy is to continue to play an important role in France's climate protection plans: In addition to the expansion of renewables, France's energy plan also provides for an extension of the lifetimes of existing NPPs and the construction of six new EPR-2 reactors at existing sites (Penly, Gravelines and Bugey). The building of eight additional new EPR-2 reactors has been under review since the beginning of 2024. France is also active in the area of SMRs: the construction of a NUWARD prototype was originally scheduled to start in 2030 - currently there is talk of the product being presented in the 2030s (‘market a product for the 2030s’).

The United Kingdom also continues to rely on nuclear energy - 12.5 per cent of the electricity produced there currently comes from nuclear power plants. Nine reactor units are currently in operation and 36 are being decommissioned. The British government has been pursuing the construction of new NPPs for some time. Two new EPR reactors are currently under construction (Hinkley Point C-1 and -2) and two further EPR reactors are planned for the Sizewell C site - preparatory construction work was originally due to begin in 2024. In 2020, the construction of new NPPs was defined as part of a ten-point plan for a ‘Green Industrial Revolution’. Building on the ‘Powering Up Britain’ policy paper issued at the end of March 2023, the British government published the ‘Civil Nuclear Roadmap’ in January 2024, which sets out the goal of expanding nuclear generation capacity to up to 24 gigawatts (GW) by 2050. It should be noted that the eight AGR units (approx. 4.8 GW) will have to be shut down for good by the end of this decade due to advanced ageing effects in the graphite moderator. The installed capacity of currently around 6.5 GW will then fall significantly, as the 3.2 GW from the new construction of Hinkley Point C will be delayed. In addition to the construction of large NPPs, the government is also promoting the development and future use of SMRs in the UK.

Five reactors are currently in operation in Belgium, with nuclear power contributing 41.2 per cent to total electricity generation in 2023. However, Doel-3 was shut down in September 2022, followed by Tihange-2 in February 2023. Three further reactors are to be shut down for good at the end of 2025 after 50 years of operation each. However, the two most recent units, Doel-4 and Tihange-3, are to continue operating until the end of 2035. The country is investing in research and development work for SMRs and the new government is also examining whether the operating life of five reactors can be extended by a further ten years (until 2035 or until 2045 in the case of the two reactors mentioned) and whether new reactors can be built.

According to the new coalition agreement, two new units are to be built in the neighbouring Netherlands in addition to the reactor unit operated in Borssele; the government is providing 5 billion euros for this purpose. The target date for commissioning the new reactors is 2035. In all likelihood, they will be built on the site of the current Borssele NPP, whose service life is to be extended beyond 60 years (would be reached in 2033).

Sweden operates a total of six reactors, which together cover 28.6 per cent of the country's electricity generation. In 2023, the Swedish government adopted a nuclear energy roadmap that provides for the construction of two (by 2033) and a further ten (by 2045) conventional reactors and SMRs. Here, too, the possibility of lifetime extensions is being reviewed.

Alongside France and Great Britain, only Finland has been actively building new NPPs: In the spring of 2023, Olkiluoto-3 was the first reactor to be connected to the grid in Western Europe since 2002. The average age of Finnish reactors is 36.9 years. Nuclear energy accounts for 42 per cent of the electricity mix. The government has also announced plans to extend the service life of the VVER 440 units at the Loviisa site from 50 to 70 years and to increase their output. Against the backdrop of the war in Ukraine, the new construction project for a Russian VVER-1200 at the Hanhikivi site was cancelled.

In addition to Belgium, Switzerland and Spain are currently planning to phase out nuclear energy: The four reactors in Switzerland (32.4 % share) are permitted to run until they reach the end of their service life but cannot be replaced by new ones. There is no specific date for shutdowns in Switzerland. There is also a debate about the existing ban on new builds, as in the opinion of some, this would not be compatible with the principle of technological openness. The seven Spanish reactors are to be gradually taken off the grid by 2035, with the first shutdown planned for 2027 (Almaraz-1).

Overall, the new construction projects in Western Europe that are actually underway or have recently been completed can be counted on the fingers of one hand. What all these projects have in common is that the originally calculated costs and construction times have increased massively.

Central and eastern Europe

In 2023, the nine reactors in Ukraine produced 50.7 per cent of the total amount of electricity. Despite the war situation and the associated safety-related risk factors, the country will probably continue to rely on nuclear power as its most important form of electricity generation, at least in the medium term. Two largely completed VVER-1000s are to be built at the Khmelnytskyi site (without Russian participation); in addition, two further AP-1000s from Westinghouse are to be built there and at the South Ukraine site to compensate for the loss of the Russian-occupied Zaporizhzhya NPP. A total of nine AP-1000 reactors are planned in Ukraine. Some of the operating reactors have been granted lifetime extensions.

In Slovakia, a fifth reactor, Mochovce-3, entered into commercial operation in 2023. Another VVER-440 is due to follow this year, which means that the country is likely to compete with France for the highest share of nuclear energy in the electricity mix. In 2022, nuclear energy accounted for 61.3 per cent of the total electricity mix.

Hungary currently obtains just under half of its electricity from four VVER-440 units at the Paks site. There are plans to build two additional Russian VVER-1200 units there, and preparatory work is underway.

In Slovenia, the only nuclear reactor at the Krško site contributes 36.8 per cent of the country's net electricity generation. In January 2023, the lifetime of the 43-year-old NPP was extended by a further 20 years until 2043. Nuclear power is to be expanded in the future in order to achieve the country's CO2 targets; depending on the demand for electricity, the construction of two nuclear power plant units is being discussed.

Two AP-1000s are also to be built in Bulgaria; an engineering contract for this was signed in November 2024 with Hyundai Engineering & Construction (South Korea) and Westinghouse (USA). It is intended to supplement the two VVER-1000 reactors at the Kozloduy site, which currently produce 40.4 per cent of total electricity, for a certain period of time and then replace them from 2050. There are also cooperation agreements with the US company NuScale, envisaging the construction of SMRs in Bulgaria.

Romania operates two Candu reactors at the Cernavoda site; two further Candu units, whose construction began in the 1980s, are expected to be completed by 2031. Romania also plans to build an SMR from the US company NuScale.

In the Czech Republic, the South Korean company Korea Hydro & Nuclear Power is to build two units of 1,000 MW each at the Dukovany site, and two new units are also planned at the country's second site, Temelin. At Temelin, the construction of SMRs by 2032 is also planned, while two further SMRs are to be completed at the Dětmarovice and Tušimice sites by 2040. Six pressurised water reactors currently produce 33.2 percent of the Czech Republic's electricity.

Poland is planning to enter the nuclear energy sector, with the first reactor due to go into operation in 2036 (instead of 2033 as originally planned) and five more to follow by 2043. Contracts have been signed with US companies (Westinghouse and Bechtel) for the Lubiatowo-Kopalino site on the Baltic Sea for the construction of three AP-1000s. At the same time, negotiations are underway with the Korean company KHNP for the construction of APR-1400 plants. Poland is also interested in the SMR technology and plans are being pursued by various Polish industrial companies together with foreign partners.

In Belarus, the country's first reactor unit was commissioned at the Astravets site in 2020, with the second unit starting commercial operation in November 2023. In 2022, nuclear energy accounted for 28.6 per cent of total electricity generation, which means that it is likely to be around the 50 per cent mark by now, assuming a certain level of availability.

In Russia, 18.4 per cent of total electricity is produced by 36 reactors, whose average age is 30.5 years. Over the last ten years, eight new reactors have been commissioned, including the floating Akademik Lomonosov NPP with two reactors. The construction of two land-based SMRs in Siberia has begun. Further units of various types are under construction (e.g. VVER-TOI in Kursk or BREST-300 in Seversk) or are being planned. Russia is also very active abroad: In addition to Hungary, Russia is realising new builds in Egypt, Iran, India, China, Bangladesh and Turkey. A nuclear power plant with four Russian VVER-1200s is currently being built there. Commissioning is scheduled to take place between 2025 and 2028. In mid-September 2024, the Turkish Energy Minister announced that the commercial operation of Unit 1 would be delayed by several months as the German company Siemens Energy was holding back key parts. Rosatom had therefore ordered the missing parts from China. Two other sites in Turkey have already been selected.

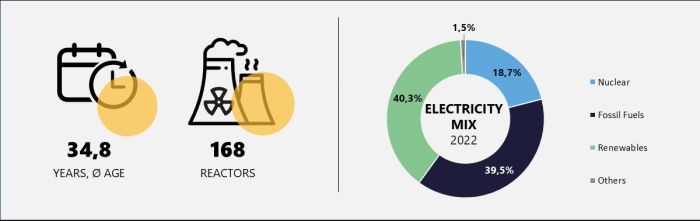

America

In 2022, nuclear energy accounted for around 13.5 per cent of the total electricity mix on the American continent. There are 118 reactors in operation with an average age of 42 years. However, there is a clear north-south divide here: While a total of 111 reactors are in operation in the USA and Canada, there are just seven to the south. Two units are currently under construction on the American continent and 49 reactors are permanently shut down.

With 94 reactors, the United States has more on the grid than any other country in the world; they provided around 18.6 per cent of electricity in 2023. The average age of the reactors is 42.9 years. Vogtle-3 and -4 were added in 2023 and 2024, respectively - they were the second and third reactors to be added this millennium (according to WATTS BAR-2 in 2016). The USA is also focusing on lifetime extensions: An extension from 40 to 60 years has already been decided for the majority of reactors, a further extension to 80 years has been approved for nine reactor units and numerous others are currently under review. However, as in some cases the retrofitting required for such lifetime extensions would have been too expensive, a number of plants have been shut down. Most recently, this affected the only unit of the Palisades NPP in the state of Michigan, which is to be restarted by the end of 2025 with government assistance. Against the backdrop of the energy and climate crisis, the state of California did not shut down the two units at the Diablo Canyon NPP as originally planned - instead, the licensee submitted an application for a lifetime extension to the US regulatory authority in November 2023, which the NRC intends to decide on by August 2025. There are also plans to recommission the Three Mile Island NPP in order to supply the Microsoft Group with low-carbon electricity. Nuclear energy was to play a greater role in the energy planning of the Biden administration; this has also been adopted by the new Trump administration. The development of new reactor concepts is to be promoted, especially of SMRs. However, the first SMR project in the USA with six planned NuScale reactors at a site near Idaho Falls was cancelled due to exploding costs. In addition, American companies are once again increasingly interested in reactor projects (including SMRs) abroad, for example in Bulgaria, Poland, Romania and Ukraine.

In Canada, 17 CANDU reactors supply 13.7 per cent of the national electricity mix (19 in 2023, so the share will have decreased in the meantime). These Canadian developments are heavy water reactors with an average age of 40.2 years. The USA's northern neighbour also relies on lifetime extensions and SMRs. No new reactor units are under construction, but the site for the first commercial SMR has been finalised: A BWRX-300 at the Darlington site is scheduled to go into operation by 2028. Further SMRs are planned - some in more, some in less concrete terms.

To the south of the USA, reactors are operated in only three countries: One CANDU-type reactor and two heavy water reactors based on a design by the former German manufacturer KWU in Argentina and two each in Mexico (BWR by the American manufacturer GE) and Brazil (a 2-loop plant by Westinghouse and a PWR based on the KWU design). The share of nuclear energy in the respective electricity mix in these countries is between 2.2 and 6.3 per cent. An SMR is currently being built in Argentina - the contract for the construction of a Hualong-1 with a gross output of 1,200 MW at the Atucha site was signed with China at the beginning of February 2022; in Brazil, work on a third unit at Angra was resumed after a six-year interruption (reference plant Angra-2).

Asia

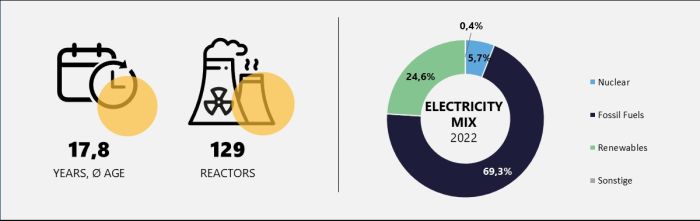

In Asia, nuclear energy accounts for just 5.7 per cent of total electricity production; 129 reactors are in operation in eight countries. In addition, there are 23 “suspended operation reactors”, 19 of which are Japanese reactors that have been shut down since the reactor accident at Fukushima. The average age of the reactors in operation is 17.8 years. In addition, 43 new units are being built here - 28 of them in China and seven in India. On the other hand, 34 reactors are being dismantled. No other continent is building anywhere near as many new NPPs. It should be borne in mind that Asia accounts for more than 50 per cent of the world's population and that energy demand has not multiplied as much on any other continent in recent decades. A correspondingly large number of other (especially fossil-fuelled) power plants have been built, which also explains the relatively low share of nuclear energy in the electricity mix.

Far East

Nuclear energy accounts for 4.9 per cent of the total electricity mix in China. This is thanks to 59 reactors with an average age of just 10.6 years. Two new reactors were commissioned last year and 28 new reactor units of various types are currently under construction. The World Nuclear Association and WNISR even mention 30 current new build projects; in addition, according to unconfirmed reports, two HTR-PM-600s (based on the HTR-PM at the Shidaowan NPP) are currently being built at the Xinan NPP. In addition to the expansion of renewables, nuclear energy plays an important role in China's efforts to reduce CO2 emissions. This is also reaffirmed in the current 5-year plan, according to which further new reactors are planned. China is also trying to enter new markets in order to sell its technology and expertise.

In South Korea, the share of nuclear energy in total electricity production is quite a bit higher: The 26 reactors currently in operation contribute 31.5 per cent of the country's total electricity. The new government has cancelled the planned phase-out of nuclear energy use; in addition to the expansion of renewables, it is intended to help achieve the country's climate targets: The share of the electricity mix is to be increased to 35 per cent by 2036; one reactor each was connected to the grid in 2022 and 2023, and two more are currently under construction. South Korea is also endeavouring to become involved in construction projects in various countries: In the United Arab Emirates, four units from Korean manufacturer KHNP have now started commercial operation, two Korean units are to be built at the Dukovany site in the Czech Republic; and talks are underway with Egypt, Poland, Saudi Arabia and Uganda, for example.

Japan is, of course, one of the countries whose energy policy has been strongly influenced by Fukushima. Before the day of the accident, 54 reactors were in operation there, contributing almost 30 per cent of the country's total electricity generation. These were all initially shut down after the disaster; 14 of them are now back on the grid, most recently the Onagawa-2 and Shimane-2 units in October and December 2024, respectively, with more to follow in the coming years. On the other hand, 27 reactors are currently being dismantled. Nuclear energy currently accounts for 5.6 per cent of the electricity mix - however, the current government is planning to increase this share to between 20 and 22 per cent by 2030. The two reactors currently under construction are also expected to contribute to this. In addition, since mid-2023, reactors may in principle be operated beyond the previous limit of 60 years. In the long run, next-generation reactors are to be built to replace old power plants.

Following the events of Fukushima, Taiwan decided to phase out nuclear energy. The only remaining reactor of the previous six is to continue generating electricity until May of this year before it is decommissioned and nuclear energy in Taiwan will be consigned to history.

Middle East

The situation is different in India, where a further seven units are currently being built in addition to the 20 reactors already in operation. The new builds are India's own developments based on the CANDU design and Russian reactor units. There are plans for a large number of other reactors, including SMRs.

Pakistan also uses nuclear energy to generate electricity, with six reactor units contributing 17.4 per cent of total electricity generation. One Hualong-1 unit each was commissioned at the Karachi site in 2021 and 2022.

A VVER-1000 has been operating in Iran for a good twelve years and a second one is under construction. According to Iranian information, another 4-unit plant is under construction at the Sirik site in the south of the country. However, the IAEA does not list this plant in its Power Reactor Information System.

There are also a number of countries in Asia that are currently starting nuclear energy programmes. These include Bangladesh, where two Russian-designed reactor units are currently being built, and the United Arab Emirates, where four reactors have successively gone into operation since 2020, the last one in March 2024.

Africa

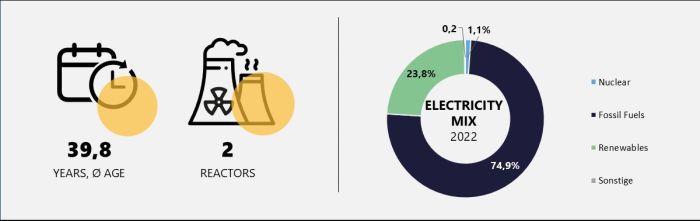

Only two reactors are operated in Africa, which account for 0.4 per cent of the total electricity mix. They are both located in South Africa, where nuclear energy accounts for 4.4 per cent of the electricity mix. Both plants were built at the same time and were connected to the grid in 1984 and 1985, respectively, resulting in an average age of 39.8 years.

However, as the continent's power grids will need to be expanded in the coming years, nuclear energy could play a greater role here in the future. This also makes the continent interesting for foreign investors, with some countries (e.g. Ghana, Nigeria, Kenya, Rwanda, Uganda) specifically looking at how to realise a move towards nuclear energy.

Four Russian reactor units (VVER-1200) are being built at the El Dabaa site in Egypt. The construction licences have been granted and work is underway. Unit 1 is scheduled to go into operation next year.