Nuclear Energy in United Kingdom (16.03.2023)

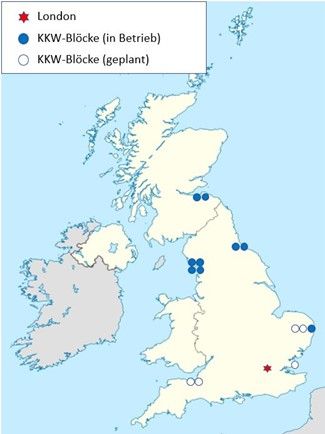

• The UK Government has been pursuing the construction of new NPPs for some time. Two new reactors are currently under construction and three more are planned.

• In addition to the construction of large NPPs, the Government also promotes the development and future use of small modular reactors (SMRs) in the UK. Since April 2022, a first concept has been undergoing a so-called Generic Design Assessment (GDA) by the British licensing and supervisory authority, and other companies have applied for a GDA.

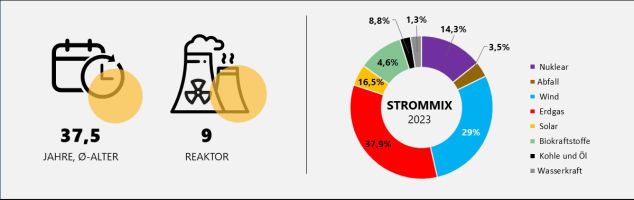

Status quo der Stromerzeugung

Im Vereinigten Königreich (nachfolgend: UK) werden derzeit an vier Standorten neun Kernkraftwerksblöcke mit einer Gesamterzeugungskapazität von ca. 6 Gigawatt (GW) betrieben. Alleinige Betreiberin ist EDF Energy, eine britische Tochter des französischen Staatskonzerns EDF. Im Jahr 2023 hat die Kernenergie ca. 14 % der insgesamt erzeugten Strommenge von rund 286 Terawattstunden (TWh) bereitgestellt. Während der Anteil der Verstromung von Erdgas nach deutlichem Rückgang bei 33,7 % lag (2022: 40 %), stellten erneuerbare Erzeugungsformen zusammen einen Anteil von ca. 40 % der Gesamterzeugung. Demgegenüber hat der Import von Strom im Vergleich zum Vorjahr zugenommen: In 2023 hat das UK per Saldo fast 24 TWh importiert.

(Anm.: Die hier zugrunde gelegten Daten stammen von der Internationalen Energieagentur (IEA), die Werte in der Grafik sind gerundet. Tagesaktuelle Daten für das UK bieten u. a. Electricity Maps und gridwatch.)

In 2020, nuclear energy provided around 16% of the total electricity volume of 313 TWh generated. The largest share was provided by the generation of electricity from natural gas (36%), followed by wind energy (24%).

The UK is currently a net importer of electrical energy (in 2022: approx. 18 TWh net import). High-voltage lines for direct current connect the country with France (2,000 MW) and with the Netherlands and Belgium (1,000 MW each). Plans include another line to France with a capacity of 2,000 MW.

Political and legal framework conditions

With the amendment of the Climate Change Act in 2019, the UK has set a target of zero greenhouse gas emissions (“net zero”) by 2050. In 2020, the construction of new NPPs was defined as part of a ten-point plan of a “Green Industrial Revolution”. Under the impression of the Russian war of aggression, the British Government has further concretised this goal also with a view to ensuring independent, domestic energy production: A nuclear generation capacity of up to 24 GWe is planned to be achieved by 2050. In this respect, it is to be taken into account that the eight advanced gas-cooled reactor (AGR) units (approx. 4.8 GW) will have to be shut down permanently by the end of this decade as graphite ageing develops. In November 2022, the Government announced the establishment of a new authority (Great British Nuclear) to promote the expansion.

One of the key instruments for financing new build projects is the so-called Contracts for Differences (CfD) scheme, which was introduced in the course of the reform of the British electricity market in 2013, along with other instruments to support investments in low-CO2 electricity generation. Under this scheme, the UK Government enters into a contract with the generator that guarantees financial compensation in the event that the market price per kWh is below the contracted price, i.e. the “strike price”. The state then passes these additional costs on to consumers. If the market price is higher than the strike price, the generator has to pay the difference to the consumers.

In the course of the above-mentioned expansion plans, a total of eight sites where NPPs or nuclear facilities are currently operated or were operated in the past were identified by parliament in the 2010s as potential sites for new build projects. A two-stage licensing procedure for new NPPs had already been introduced previously, in the first stage of which the licensing authority (Office for Nuclear Regulation, ONR) carries out a so-called Generic Design Assessment (GDA) on application for a specific type of plant and independently of a specific site. If this assessment shows that the type in question basically meets the current safety requirements, ONR grants a Design Acceptance Confirmation (DAC). In parallel, an assessment is carried out by the Environment Agency. So far, the GDA has been successfully completed for the following types: UK EPR (EdF), AP 1000 (Westinghouse), Advanced Boiling Water Reactor (ABWR, Hitachi-GE) and HPR 1000 (China General Nuclear Power Group, CGN).

In March 2023, the UK and France signed an agreement to increase cooperation in the nuclear sector. Among other things, the agreement provides for a joint working group on innovative reactor concepts and safety.

In March 2023, the UK and France signed an agreement to increase cooperation in the nuclear sector. Among other things, the agreement provides for a joint working group on innovative reactor concepts and safety.

Current plans and projects

Large NPPs. Since 2016, EDF Energy has been building two UK EPR NPPs with an electrical output of 1,600 MW each at the Hinkley Point site. In the meantime, the project has been delayed several times (among other things as a result of the Covid pandemic) and costs have increased considerably. In July 2022, EDF Energy stated that completion might not be expected before September 2028. The project is financed by EDF Energy and the Chinese CGN. Since 2020, the British Government has been critically reviewing Chinese investments in UK infrastructure (see below), but the Hinkley Point project is apparently not affected. A key element of the financing is a Contract for Difference (CfD) with the British Government. This financing instrument was introduced, among others, to support investments in low-carbon power generation in the course of the reform of the British electricity market in 2013. The CfD guarantees the generator financial compensation in the event that the market price per kWh is below the contractually agreed base price, i.e. the “strike price”. The state then passes these additional costs on to consumers. If the market price is higher than the strike price, the generator has to pay the difference to the consumers.

Two more UK EPR units are to be built at the Sizewell site according to EDF Energy's plans. CGN is also involved in this project so far; the Chinese share is 20%. Against the background of its critical stance towards Chinese participation in large infrastructure projects, the UK Government already provided £100 million for the project in January 2022, and in June 2022 it announced that it would work towards acquiring a 20% share in the project, which would allow for CGN’s exit from the project. In November 2022, the Government declared that the British state would invest £700 million in the project. In addition, the Government is seeking to implement a so-called Regulated Asset Base (RAB) funding model, which would guarantee investors a fixed return during the construction phase.

EDF Energy and CGN are also planning to build a new NPP at the Bradwell site, but with a majority shareholding by CGN (66.5%). In contrast to Hinkley Point and Sizewell, it is planned to build an HPR 1000 reactor here, with two units in the medium term. The HPR 1000 is a modified version of the Hualong One built in China, a Chinese development, which in turn is based on the French 1,300 MW design. The GDA for the UK HPR 1000 was successfully completed in February 2022, and the UK regulator had already granted the Bradwell B Power Generation Company – a joint venture between EDF Energy and CGN – an electricity generation licence for the project in December 2020.

SMRs. Since the mid-2010s, the UK's nuclear policy has been geared towards promoting SMR concepts and their medium-term deployment. Following a competition launched in 2016, the Government awarded £40 million in 2020 to support research and development. Companies that declared their intention to develop or deploy their respective SMR concepts in the UK as part of the competition include NuScale, Westinghouse, as well as GE-Hitachi and Moltex Energy (the latter two aiming to deploy fast reactors that will contribute to using or disposing of the UK's plutonium stockpile). In 2019, the Japan Atomic Energy Agency (JAEA) formed a joint venture with a UK company to build a 10 MW SMR in the UK, the design of which is based on a high-temperature reactor operated in Japan, to generate electricity and process heat, as well as a factory to build these plants.

The closest to actual construction is probably the SMR concept of a consortium around Rolls Royce, whose concept with an electrical output of just under 500 MW, however, no longer corresponds to the usual SMR definitions, depending on how it is read. The British Government has already funded the consortium with £210 million in 2021. The GDA procedure started in April 2022. In autumn 2022, a number of potential sites for the construction of Rolls Royce SMRs were published.

By early 2023, six more companies have applied or plan to apply shortly to the UK Department for Business, Energy & Industrial Strategy (BEIS) for approval of a GDA procedure for their SMR designs. These are GE Hitachi for the BWRX-300, Holtec Britain for the SMR-160, Cavendish Nuclear/X- Energy for the Xe-100, GMET Nuclear for the NuCell SMR, Newcleo for a lead-cooled SMR and UK Atomics for the Copenhagen Atomics Waste Burner.

Research reactors

Over the past decades, a large number of different research and prototype reactors have been operated in the UK, including larger high-temperature reactors and fast reactors with outputs of over 20 MW. Currently, only Rolls Royce operates a so-called critical assembly (also known as a “zero power reactor”) for testing purposes.

Uranium enrichment

Urenco, whose shares are held in equal parts by the UK, the Netherlands and (as the German share) by RWE and E.ON, operates three uranium enrichment plants at the Capenhurst site, in which gas ultracentrifuges are used.