Nuclear Power in the United States (US) (as at: 02/08/2023)

• Another new build, Vogtle-4, is currently in the commissioning phase

• The US has the world's largest nuclear power generation capacity

• With NuScale, GE Hitachi Nuclear Energy and TerraPower - to name just a few - concepts for Small Modular Reactors (SMR) are being developed in the US, and cooperations with (European) countries are underway.

Status quo of power generation

In 2020, the US generated 4,392 terawatt hours (TWh) of electricity. In addition, the country imported around 47.3 TWh. The US meets more than half of its electricity demand from fossil fuels, especially gas and coal.

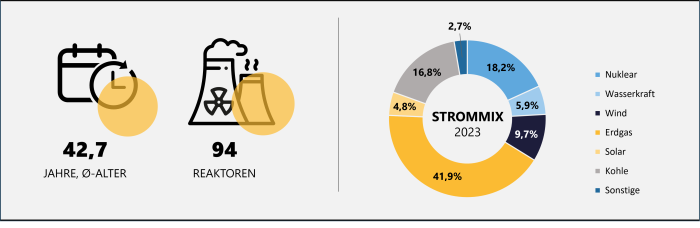

The 93 nuclear power plants (NPPs) contribute more than half of the low-carbon electricity generation in the US.

Political and legal framework

The Biden administration has announced a goal of zero emissions by 2050. Since energy demand in the US states is expected to continue to rise, new generation capacities amounting to about 22 gigawatts will be needed by 2030 alone. In addition to renewable energies, the US is focusing in particular on the development of SMRs as a "clean technology" and has established or supports several initiatives to promote these technologies (including FIRST - Foundational Infrastructure for Responsible Use of Small Modular Reactor Technology, GAIN - Gateway for Accelerated Innovation in Nuclear, or ARDP - Advanced Reactor Demonstration Program). Accordingly, a bill was approved by the US Senate Committee on Environment and Public Works in June 2023 that aims to accelerate the deployment of advanced reactors and promote research and development.

In the course of the US energy plans, the operating lives of almost all reactors were extended from 40 to 60 years. Under certain conditions, the Nuclear Regulatory Commission (NRC) also allows a further extension to up to 80 years after 60 years. Six reactors have already received this approval, and applications have been submitted or are under review for at least seven others (e.g. Monticello NPP, whose operating licence currently runs until 2030). In California, an application was made to extend the operating lives of the two units Diablo Canyon 1 and 2, although the shutdown date of 2024/25 had already been set. Studies (e.g. by the Massachusetts Institute of Technology) had concluded, among other things, that the NPP would improve grid stability under the current legal, economic and ecological conditions. As a result, the two units were required by law to remain in operation, and an application for an extension of their operating lives has since been submitted to the regulatory authority.

As part of their efforts to expand power generation capacity in the US, government and industry have been working on a design approval for Generation III reactors. This would allow a standardised reactor type (e.g. a Westinghouse AP1000) to be built anywhere in the US after a thorough review of safety requirements. Only site-specific licensing procedures would have to be completed and a combined construction and operating licence obtained. The licence would have to be renewed after 15 years. Construction licences have already been issued for some plants approved in the USA. The price of gas, which has been stagnating at a low level for several years, does not allow for large new nuclear construction projects, such as the one at the Vogtle site, for reasons of profitability.

Current plans and projects

Large NPPs. In April 2008, Georgia Power signed an EPC contract with Westinghouse and The Shaw Group (now CB&I) consortium for two Westinghouse AP1000 reactors, each with a capacity of 1,200 MWe, to be licensed by Southern Nuclear Operating Company (SNOC) and operated at the Vogtle site in Wyoming. Unit 3 was connected to the grid on 1 April 2023 and began commercial operation on 31 July. After the regulator approved fuel loading at the end of July, it is expected that Unit 4 will be ready for commercial operation in early 2024.

In addition to the costs, the operators also did not see sufficient signals from politicians to provide low-emission, base-load-capable generation capacities. Now the components of the power plant that have not been permanently installed are being sold to other new construction projects.

SMR. In the US, numerous concepts for so-called Small Modular Reactors (SMR) are in various stages of planning or development. One of the most promising is the VOYGR-SMR from NuScale. Four, six or twelve of the pressurised water reactor modules can be combined to form a NPP with a maximum of 924 MWe. A 50-MWe version of the NuScale SMR had been granted type approval by the regulatory authority NRC in 2020 and the official certification of the design was announced in early 2023. In a current proceeding, the concept of a plant with six 77 MWe modules is being tested as part of the Carbon Free Power Project (CFPP) in Idaho Falls (USA) at the site of the Idaho National Laboratory. An application for preparatory construction measures was submitted to the regulatory authority in August 2023. It is expected that the application for a Combined Construction and Operating License (COL) will be submitted in early 2024 and construction will start in mid-2025. The SMR is expected to be operational in 2029. NuScale is already marketing the SMR in Europe and has signed cooperation agreements with Bulgaria, Poland, Romania, the Czech Republic and Ukraine, among others.

The SMR developer TerraPower is currently planning a sodium reactor as a demonstration project in Wyoming, which is to replace a decommissioned coal-fired power plant from 2030. Plans for up to six more SMRs are to be put into concrete terms by 2025.

With the BWRX-300 from GE Hitachi Nuclear Energy (GEH), another US SMR concept is being developed. It is being subjected to a so-called pre-licensing review not only in the US, but also in Canada and Great Britain. The Tennessee Valley Authority, for example, is currently preparing a draft construction licence application for the construction of an SMR at the Clinch River site. The company plans to submit the application at the end of 2024.

And Westinghouse, too, is entering the race with an SMR. The AP-300 is based on the AP-1000 and is intended to use its systems and supply chains so that the construction time can be reduced to about three years. A plan for the AP-300's pre-design licence application has been submitted to the US regulator, the NRC. The company expects the new design to receive NRC approval in 2027 and the first plant to be operational in 2033.

Other developments are being driven forward by Kairos Power (MRS test reactor Hermes, Oak Ridge), Holtec International (SMR-160) or Dow together with X-energy (Xe-100 high-temperature reactor), among others. With regard to Kairos concept, the NRC submitted its comments on the environmental impact assessment in August 2023.

Research reactors

In the USA, 30 research and test reactors are in operation, while other such reactors are in the process of being decommissioned or are awaiting licensing. The reactors are affiliated with major research institutions, universities and colleges. The activities in this field are bundled and coordinated in the NEUP (Nuclear Energy University Program) initiated by the Department of Energy. In addition, the Department of Energy has its own research/test reactors.

Fuel fabrication and processing plants

US production of uranium concentrate (U3O8) was 2,511 pounds (about 1.1 tonnes) in the first quarter of 2023. This represents a 75 per cent decrease from production in the first quarter of 2022 and a 99 per cent decrease from the fourth quarter of 2022. The country now sources much of the uranium for use in its commercial reactors from abroad. To reduce dependence on nuclear fuel from countries such as the Russian Federation, priority has been given to domestic uranium processing (conversion and enrichment) and fuel assembly fabrication since 2022. In addition, the development of High-Assay Low-Enriched Uranium (HALEU) capacity, which is also needed for some advanced reactor concepts, is to be accelerated. HALEU is uranium enriched such that the concentration of the fissile isotope U-235 is between 5 and 20 per cent of the mass of the fuel.

Currently, the country has a commercial enrichment plant operated by Urenco and several fuel fabrication companies (including Framatome). In Utah, Western Uranium & Vanadium is planning a processing plant that will process uranium from the recommissioned Sunday Mine Complex. NANO Nuclear Energy is planning to build a fuel fabrication plant at the Idaho National Laboratory. In addition, US-based Oklo has submitted a project plan to the NRC for licensing of a nuclear fuel reprocessing facility. The goal of this plant is to produce advanced fuel from highly radioactive waste.